Oh boy! What a week, over a $100Billion evaporated from the markets in the worse week in years and whilst my portfolio has slipped 10% recently, (yes backwards) I find myself answering the cry of '' your no expert and you're a shit tipster '' jeez Louise as if I'm solely to blame for the collapse in the oil price or in fact the slump in the junior resource space...

I think its safe to say the markets are full of utter twerps, some of which '' see no evil, hear no evil '' but my sanity is replenished when i speak to guys like Josh who are not only industry experts in their field but ruddy good folk to suit. I've spoken to a few good folk recently and discussed a wide variety of topics so accept that whilst there is an army of retail punters relying on blind faith! there are also the Alex or Josh of this world to give me hope.

I work 18hrs each day, eating,sleeping and shitting the stock market and yes I'm a saddo! not as sad as my mate Tom Winnifrith but sad nonetheless. Now to be clear to the odd loony that goes to the trouble of setting up accounts to sling shit towards myself or anyone else for that matter, you really must take heed of this message:

I'm about as thick skinned as you can be, feel free to spout off all you like, your engagement with me ends instantly when i hit the block button, there are plenty of people I have had heated debate with that I follow and engage with (even if I strongly disagree with them) however mutual respect for anothers opinion was the way I was brought up, now you might be thinking if he's that thick skinned why comment? I want to be very clear here:

I'm not an expert, I have tipped companies that have gone to zero (just the one but hey) and I have believed in an asset prior to finding out just how bent certain executive officers of companies are. I accept those calls, I accept people criticising me and I accept that life's like a box of chocolates. Feel free to oversee some of the biggest calls in the small cap sector over the last few years, I opened my account as a writer with a company that did a 40% or 60% gain (it slips my mind now).

it took a few months and i was ecstatic, I held no position as I didn't want any emotional distractions. My time as a writer consisted of picking stocks 90%+ of which i wasn't financially reliant on or exposed to. Any writer worth his salt will tell you that its hard enough without the added pressure, however overtime I found myself backing winners and losers in the markets as well as writing. The point here is I disclose my positions as much as I can, if i write i say if i hold or not, if i tweet i may or may not say what I hold and when but this is often down to the lack of time in the day to keep a full diary from the 15,000 tweets I've made. What I will say finally is I have put as much into this industry as I have taken out which is more than a lot of the punters looking to shoulder blame with someone else for there lack of knowledge. At this point and old analogy comes to mind.

- You can lead a horse to water but you cannot make it drink....

Now to the overview of the markets and the companies that are hot or not, not, not,not, with over one hundred billion evaporating this week its been hard on most.

Sula Iron & Gold: The company released news this week which clearly triggered further interest in the companies pending JORC results, clearly Sula has had a really tough time the geographic position of sula's assets are less than favourable with the ebola outbreak however chief worrall has been out country overseeing some of the work. The very fact Nick sees it fit to travel tells you everything, his experience in the field and country is invaluable so whilst times are hard it just shows that there is some interest within the resource sector.

Sound Oil: I've watched the world collapsing around oil stocks recently and whilst sound has come off a little from the 12-13.5p range it has shown the aggressive appetite to go after projects and companies that it believes offers significant upside against a limited down. Sound Oil is actually a predominant gas play with assets out in Italy, fiscal terms are good, they have revenue from 2 x producing wells which covers G&A cost thus the finance (funding) is being sunk into game changing operations like Badile which is valued at $400m upt $1.2bn. There is a high risk associated with drilling this well however the reservoir value is huge, so much so that industry majors are looking at the company closely. With oil on its uppers its hard to know where things can go but rest assured that those with the strongest outlook will hold on longer and recover quicker.

Management Resource Solutions: Come off 20% on their second day in the markets, rough justice for a company that has a revenue stream,dividend and by the admission of the company are ahead of expectations. With news due early 2015 to finger this very point it won't be long before MRS is picked up, the company came to life 7 years ago doubling in size each year. It's my belief we will see more of this as the next month or two unfolds, in a recent interview the CEO said we are acquisitive thus intend to keep growing not sit stagnant. I think there are a few misunderstandings in the market when it comes to MRS, one is they raised cash at 7p before coming to market! I have it on good account this is not the case after chatting with an analyst who carried out DD on management resource solutions. The other is they are a recruitment business and with things not looking hot in that field then its one to miss. Personally i see the infrastructure budget and boom a great assurance to the company and whilst I accept coming to market in the worst week in 2 years is about as bad as it could be. Companies with a revenue stream, profits,divi's and ambition often become seen as safer havens for risk in portfolios of private investors. Sustainability is very much taken care of...

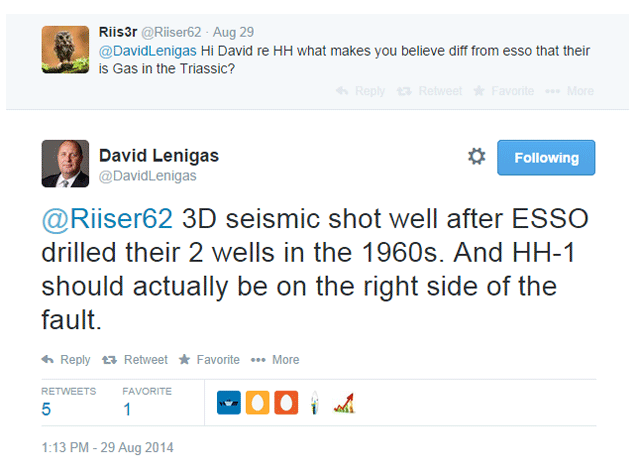

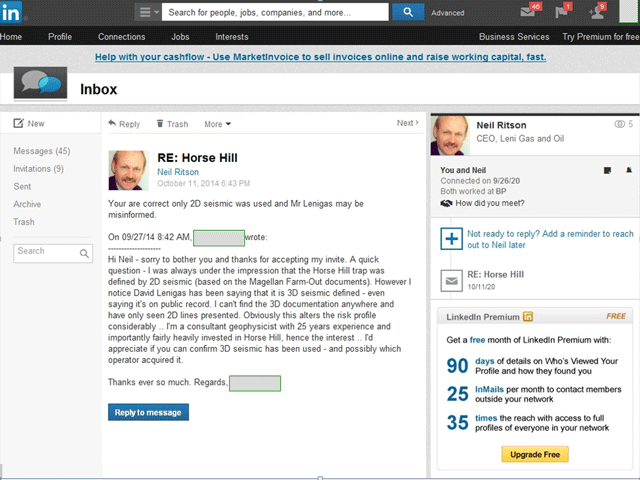

UK Oil & Gas: I backed this first time around at 0.35p as many of you know and whilst the 2d/3d seismic scandal showed a level of visibility the HHDL chairman has, we have to take a measured view of events. Most of the stock has changed hands much higher (great) the company has raised money to enter the next bidding round (great) UKOG has secured a bunch of assets from NOP (overpriced but hey ho) and they have some production. I don't see them going bust even in this market so at worse will baton down the hatches, however the grand master of promotions Mr David Lenigas has not returned to take stick, he like the glitz and glamour of aim and I'm as sure as eggs that he has something brewing in here (great) which is why I'm back holding for the big game....

African Potash: Ed Marlow went onto Tiptv Friday and give a great account of himself, the shares have been hammered form 4.88p to a penny. Strong rumors are surfacing that a deal is imminent with either the Chinese or Indians as Ed's mecca ensues AFPO shareholders wait with baited breath. To quote Ed from the interview he clearly states '' I cannot tell you for regulatory reasons that we are in negotiations (referring to take out suggestion) however I'd be silly not to be in dialogue '' which is then validated by the recent hole results from the Lac Dinga project and the size/value of neighbouring assets. As with all things mining its hard work but potash is a commodity which is growing in demand in order to help fertilize and feed the world.

BoxHill Technologies: The company has one of the craziest stories around however with accounts due out to show the world isn't ending (i.e recovery underway) and with a gaming (gambling access) gateway both online and in casino's it means that players can get cash onto a table or into an online account to enjoy their pastime, we could be wrong to think walking into a bookies or casino is normal but in many countries including the U.S its now difficult to access cash to play. Box has the software to work with online providers to enjoy a sensible punt at the 2.10 newmarket or maybe a spread bet on the forex. The interesting factor is the access to the casino's of London where Boxhill are popping up with on site facilities to offer players cash at a 4.9% charge. It's all easy money and should Phil Jackson and his small team keep it up then Box will bounce back with a bang.

Finally, twitter,forums and bulletin boards - Sadly it would appear that twitter is becoming a conduit to over promote and ramp a company, it reminds me of the BB's 2 or 3 years ago!!! It's not big and its not clever, it's also highly off putting so in the New Year I'll be reevaluating my account and its use. Perhaps a clean break all around is needed - these environments are highly influential and damaging.

Note: I was something of a Directors Talk fan when the site first come to life and whilst I appreciate some of what they do I really can't abide the site over promoting shit in a one dimensional perspective, thats not news its marketing or promotions. Please be clear who are your client and what is news, and what is promoting. This is a warning to private investors '' whilst i/we give it a chance to correct the slip in quality we should be aware that this is now falling into the hands of the corporate and out of the retail palms....