Good Afternoon,

As we reflect on the week gone by its yet another move towards the santa rally in a bunch of companies (more later) the prime question is will the forthcoming taper announcement inject confidence or slay further excitement.

I chose the words confidence and excitement carefully as often the doom and gloom is associated with analytical evidence of how screwed up the main exchanges appear, As a thick headed northerner with an eye cast over the small cap sector I often ask the question '' When will the city see no further value holding those long positions on the main exchanges '' If a collapse comes wether it be driven by the taper announcement or more importantly the wind of change blowing over the markets in early 2014 I still maintain a cyclical upturn year on year in the smallcap. The theory is any major exchange pain will subside as the aim has been butchered thus the potential investing/trading or simply playing from this level as a giveaway market, On the other hand should confidence continue to maintain its trajectory then this will surely resonate with the small cap's alternative market.

Many times I get asked how can you hold a proactive outlook on the small cap then tear a strip off the market? Well quite simply you have to understand the flight line of the company as its stimulated by need!!! ''the city's needs, the companies needs and the markets needs....''

The aim market is a feeding ground for all that is toxic and a breeding ground for all that is good, the line is so fine that we have to monitor the evolution of each company, measuring success and failing along the way. All too often the corporate language the city uses rarely mention the pavement of shite they themselves are walking amongst. The motivation for complete denial or '' The Nelson approach '' is due to their needs.

Value doesn't often fall at your feet in the markets however following simple,robust and proven principles help.

Savannaha Resources: This week I draft a piece on SAV put held of releasing it as the shareprice was getting away from the focal entry point. Alo has shot to fame over the last few weeks and while the company have tried to temper excitement the SP has held up quite well which has shown a natural reflective hit. The risk for the investors buying in the 3's is minimal but at 4.5-5p I'm not happy to cover. If it retracts I guess I'll cover, for now the company is getting plenty of lime light! which is fair to say and fair value offset against the current position in the grid for Savannah.

Union Jack Oil: has yet again moved off the bottom as buyers took the share price up from 0.26p to 0.30p the share price has a 12m high of 0.40p and a low point 0.22p I think the bottom has been founded, the ascending lows would suggest a retest and possible break of the high (0.40p) if that goes then its new territory, the risk lies with a fail and pull back to 0.27 area. Its very early days for UJO but I'll be looking at the company closer at the delivery over the next 12 months. '' Do we have a potential runner or flop? '' the passage of time will tell.

Gulf Keystone: I have been waffling on about this company for such a long time that its now becoming old hat to even me but when the SP hits that 200p then 240p marker we can at least reflect on the turmoil investors had endured before getting back to a relevant value.

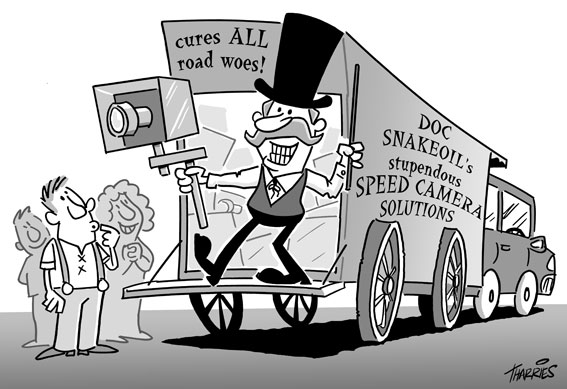

Range Resources: I see Tom revised his position on RRL but to be frank I have not. I think PL is an awful CEO as he has pretty much capitulated to the hype. Did he create it? I have no idea. Has he delivered? Well the share price tells the story but the alleged back alley affiliations with people fighting extradition as claimed in this piece here is enough for me to avoid. As for forum fool wiggy well he was pumping RRL and USOP and look at the preformance £6 to 16p and 24p to 1.2p says he talks a lot of crap whilst masquerading as an intellectual investor. - Take heed of these charlatans on every forum. Remember every dog has its day but a confirmed bullish reversal is a much better entry than sitting on the forever eroding psychological jibba jabba of any company.

Noricum Gold: I have been critical of all the overvalued Solg/Marl etc. However Noricum has proved its ability now to trade at this level and as long as the SP trades above the 200dsma then I would suggest the share price will revisit 1.15p and beyond. .

http://www.shareprophets.advfn.com/views/3040/noricum-gold-buy-at-084p-target-115p

I have been asked about ACP and DOR a while ago but I kept my feelings private however the Dor response was that the return cash wise would not be significant enough to value the business at 0.40p+ on a fundamental basis as of yet. ACP well I really hold no direct opinion other than a rebrand of a business which gives options to its directors of around 5% of the business and then raises a million quid invests in some potentially tinpot asset which suddenly thrust the market cap up significantly really isn't the foundation of a long term investment unless your due diligence is spot on or you have some inside info, Its my thoughts that the SP was plumped up to house a £550,000 fundraise which is pretty much the reason the SP in both companies has been going the wrong way.

Thats not to say you can't make a buck from banging the doors on these kind of companies! You just have to manage your own expectations against risk.

Well folks as the roast pork sizzles and I nurse a heavy head after the exuberance of the works night out, I bid you all a good afternoon....

All the best

Doc

https://twitter.com/DDS_Doc_

http://docslaymanschatter.

Featured on SP.com

http://www.shareprophets.com/

Subscribe free for a daily share tip.

http://uk.advfn.com/one-free-

Featured on Ofst every day.

http://uk.advfn.com/one-free-

(These are but opinions derived from my own experiences and thoughts and do not adopted as statement of fact)

No comments:

Post a Comment